Analysis: A corporate director for 4 oil and gas companies joined the OTPP board a year ago. What have those companies been up to?

The recent actions of four companies, on whose boards Ontario Teachers’ Pension Plan Director Deborah Stein sits, are indicative of an oil and gas industry that is expanding fossil fuels, lobbying to block government climate action, and fighting tooth and nail to prolong the use of fossil fuels. These companies are acting in ways that directly undermine the OTPP’s commitment to net-zero emissions and the rapid transition away from fossil fuels that is required to protect the retirement security of working and retired Ontario teachers. A year after Ms. Stein joined the OTPP Board, let’s take stock of what the companies on whose boards she sits have been up to in 2023.

Oil and gas insider Deborah Stein joined the OTPP’s Board on January 1, 2023

In December 2022, working and retired teachers from across Ontario asked the Ontario Teachers’ Federation (OTF) to retract its appointment of Deborah Stein to the Board of Directors of the Ontario Teachers’ Pension Plan (OTPP). Their letter to the OTF was published as an op-ed in The Toronto Star and covered by the National Observer.

Over 160 working and retired teachers called on the Ontario Teachers’ Federation to retract its appointment of Deborah Stein to the Ontario Teachers’ Pension Plan Board in 2022. Source: Toronto Star, November 24, 2022.

Teachers expressed concerns that Ms. Stein sits on the board of four different oil and gas companies, the actions and interests of which the teachers felt are incompatible with the OTPP’s net-zero emissions commitment and with OTPP directors’ fiduciary duty to invest in the best long-term interests of pension plan members. Working and retired teachers perceived a potential for conflicts of interest between Ms. Stein’s legal obligation to protect their retirement security and her legal obligations to maximize shareholder value for the four different expansionist fossil fuel companies for which she is a director. Beneficiaries expect OTPP directors to make decisions impartially on matters related to the implementation of the pension fund’s climate strategy, which must include an end to investments in fossil fuels in order to be credible.

Nonetheless, the OTF and the OTPP defended the decision, and Ms. Stein joined the OTPP Board on January 1, 2023. She chairs the Board’s Audit & Actuarial Committee and sits on its Governance Committee. The OTF claimed that Ms. Stein is “passionate about ESG issues and the challenges of climate risk” and has “deep experience and knowledge in how transitioning companies can be supported.” Over a year after joining the OTPP Board, Ms. Stein continues to serve on the boards of NuVista Energy, Washington Gas, Trican Well Service, and Parkland Corporation. Only one of these fossil fuel companies has committed to net-zero emissions, while none of them have released a credible climate transition plan. According to her LinkedIn page, Ms. Stein was until 2015 also the Executive Vice-President and Chief Financial Officer of AltaGas, a North American fossil gas infrastructure company, and was previously a director of Iron Bridge Resources, a Calgary-based oil and gas exploration and production services company that was acquired by Velvet Energy in November 2017.

Meanwhile, the climate crisis has continued to worsen and accelerate. 2023 was by far the hottest year on record and brought devastating wildfires, storms, floods and heatwaves that were made more likely and severe by global heating. Millions of people in Canada and around the world are suffering the consequences of the climate emergency. The crisis struck close to home for OTPP members, when teachers in Ontario cancelled year-end field trips and kept their students inside for recess and gym class in June because the smoke from wildfires threatened their health.

The primary cause of the climate emergency is unambiguous: the production and combustion of fossil fuels. That’s why the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC) warned (again) that limiting global heating to 1.5°C requires an immediate end to expansion and the rapid phase-out of oil, gas and coal. At the COP28 climate summit in Dubai, the international community for the first time formally agreed on the urgent need to transition away from fossil fuels.

Yet fossil fuel companies continue to explore for and extract more oil and gas and build and expand fossil fuel infrastructure while running sophisticated lobbying and public advertising campaigns designed to block or delay government climate action.

Now might be a good time to take stock of what the fossil fuel companies on whose board Ms. Stein sits have been up to in 2023, so we can better understand the OTF’s assertion that putting an oil and gas executive on the board of the OTPP somehow advances the OTPP’s implementation of a credible climate plan.

For a detailed assessment of the actions of each company, click here to jump to the Appendix.

Deborah Stein is a corporate director of companies that want to keep us hooked on fossil fuels

The assertion that Deborah Stein is “passionate about ESG issues and the challenges of climate risk” and has “deep experience and knowledge in how transitioning companies can be supported” does not seem supported by the actions of the companies she serves. The companies on whose boards Ms. Stein sits are expanding fossil fuels, lobbying to block government climate action, and fighting tooth and nail to prolong the use of oil and gas. These companies are acting in ways that directly undermine the OTPP’s commitment to net-zero emissions and the rapid transition away from fossil fuels that is required to achieve net-zero emissions, ensure a safe climate future, and protect the retirement security of working and retired Ontario teachers.

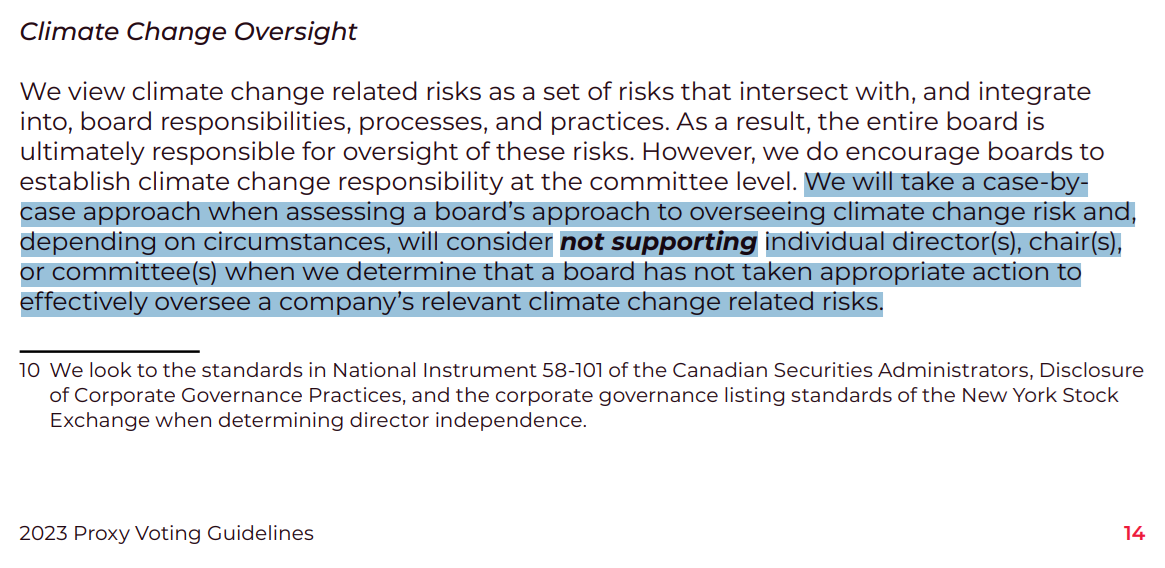

Ms. Stein and the fossil fuel companies on whose boards she sits do not even measure up to the OTPP’s own Proxy Voting Guidelines, which state how OTPP expects public companies to manage climate-related risks. The Guidelines say that companies “should provide short-, medium-, and long-term carbon/greenhouse gas (GHG) emissions reduction targets and their progress towards those targets. Targets should be scaled (i.e., interim target setting) and with an aim towards net-zero emissions by the year 2050 (or earlier).” The guidelines say that the OTPP will “consider not supporting (emphasis OTPP’s) individual director(s), chair(s), or committee(s) when we determine that a board has not taken appropriate action to effectively oversee a company’s relevant climate change related risks.” Presumably, these guidelines would compel the OTPP to vote against Deborah Stein herself in her role as a director of fossil fuel companies!

At best, Ms. Stein could be bringing a fundamentally flawed perspective on the energy transition, climate risk and fossil fuels to the OTPP Board. At worst, her legal obligations to four different expansionist fossil fuel companies could potentially undermine critical decisions the OTPP must make to implement its climate strategy and achieve net-zero emissions. Teachers wouldn’t expect the director of a tobacco company to phase out cigarettes, just like they don’t expect the director of four different fossil fuel companies to phase out oil and gas. It’s difficult to see how teachers wouldn’t see this as a conflict of interest.

Conclusion

Unions and their federations, like the OTF, are essential to protecting the interests of teachers and all working people. Ontario’s teachers’ unions work to defend public schools, ensure a safe learning environment for students, and fight for fair compensation and working conditions for teachers. Unions are also key allies of the environmental movement in supporting laws and regulations that protect public health and the climate in Ontario and Canada. The OTF must also represent the best interests of teachers in the governance of their pension plan. That’s why it’s so disappointing that the OTF appointed to the OTPP Board a director of four different fossil fuel companies that are undermining our shared goals.

Amidst a worsening climate crisis, Ms. Stein’s fiduciary duty to invest in the best interests of Ontario teachers and oversee OTPP decisions on investment strategy, climate risk and energy transition is incompatible with the shareholder interests of the oil and gas companies on whose boards she serves.

The OTF made a mistake in appointing Ms. Stein to the OTPP Board. Fossil fuel interests do not belong on the board of a $247-billion pension fund for public school teachers. Ms. Stein’s OTPP directorship should not be renewed at the end of her first term on December 31, 2024.

The OTF should instead appoint a director with the financial expertise needed to navigate worsening climate risks and protect teachers’ pensions and the planet, not someone legally obligated to act in the interests of oil and gas companies undermining our collective future by keeping us hooked on fossil fuels. When conducting executive searches to appoint new pension board members, all unions and governments that are pension fund sponsors should add climate risk expertise as a desired skill for directors and avoid real or perceived conflicts of interest by screening out candidates who serve as directors or executives of fossil fuel companies.

Appendix: What were Deborah Stein’s fossil fuel companies up to in 2023?

NuVista Energy

Deborah Stein sits on the board of NuVista Energy, where she sits on the company’s ESG committee. NuVista is a Calgary-based oil and gas company that explores for and produces oil and gas in western Canada. NuVista is also a significant producer of condensate for Canada’s oil sands industry. The company co-owns and operates the Wembley Gas Plant in Grande Prairie, Alberta, where NuVista’s gas is responsible for between 40% and 50% of the plant’s throughput. NuVista does not have a net-zero emissions commitment.

Screenshot of NuVista Energy’s home page showing its prominent display of oil and gas booster group Canada Action. Source: https://nvaenergy.com/.

NuVista Energy prominently displays an “I♡🍁OIL&GAS” icon, the logo for Canada Action, on the home page of its website. Canada Action is an organization that promotes the interests of Western Canada’s oil and gas industry through public engagement and social media activities. The group has a long and well-documented history of supporting oil sands expansion and pipeline development. It is supported by a broad network of individuals with deep ties to the oil and gas industry, the Conservative Party of Canada, Alberta’s United Conservative Party, and right-wing extremists such as “Freedom Convoy” organizer Tamara Lich.

Despite dire warnings from the IPCC, IEA and United Nations that limiting global temperature increase to 1.5°C requires an immediate end to oil and gas expansion and a rapid phase-out of production, NuVista increased production every year between 2017 and 2023 (achieving record quarterly production in 2023) and plans to increase production by 10% and 20% per year over the next five years.

According to its Q2 2023 reporting, NuVista’s production declined in the first half of 2023, due to “temporary challenges from the Alberta wildfires.” But the company was “pleased to announce record high weekly production,” highlighting new wells coming online, increased drilling activity, and investment in production growth, with a plan to increase production from 71,000 barrels of oil equivalent per day (boe/day) in 2023 to 100,000 boe/day in 2025. NuVista had to shut in some of its production in Q2 due to the Alberta wildfires, the frequency and intensity of which were enhanced by climate change. As Stein serves on the board of a company that’s expanding oil and gas production even as its own operations are directly affected by climate impacts, it’s absurd to argue that she somehow brings expertise in climate risk and energy transition to the OTPP board.

According to its Q3 2023 reporting, NuVista increased oil and gas production by 17% over Q3 2022, bringing its quarterly production to a record high. NuVista also drilled 16 new wells. Going forward, NuVista plans to increase production to 105,000 barrels per day in 2025. NuVista’s Board approved the company’s production increase for 2024. NuVista reports it’s “in the early planning stages” of adding more capacity and “extend(ing) our prudent growth well through 2026+.”

According to Q4 2023 reporting, NuVista highlighted another “new record” for quarterly oil and gas production and said it expects to add new reserves and drill new wells in 2024 and 2025.

NuVista’s 2022 ESG Report shows reductions in the emissions intensity of its operations in 2022, but also shows an increase in absolute emissions (scope 1, 2 and some scope 3). The ESG Report, entitled “Delivering Responsible Energy”, makes many greenwashing statements that are inconsistent with both Paris-aligned emissions scenarios and global oil and gas demand outlooks, claiming that NuVista “feel(s) a responsibility to contribute to the world’s energy needs” and that fossil gas “can play a very important role in reducing world carbon emissions.” The ESG report also includes an “Enterprise and Climate Change Risk Management” framework informed by the recommendations of the Task Force on Climate-related Financial Disclosures. The framework outlines how NuVista views the actions required to limit a dangerous increase in global temperatures as “risks”, including public opposition to fossil fuels; policies, legislation and regulations focused on restricting GHG emissions; and stricter environmental standards and enforcement, larger fines and liability.

NuVista is a member of the Canadian Association of Petroleum Producers (CAPP), the lobby group for Canada’s oil and gas industry with a long and well-documented history of styming ambitious government climate policy federally and provincially.

NuVista is also part of the Rockies LNG coalition, a partnership of fossil gas producers advocating for increased production and export of Western Canadian fracked gas. The coalition is seeking regulatory approval to build the Ksi Lisims liquefied natural gas (LNG) terminal in northwestern BC, which would process and export 12 million tonnes per year of liquified fossil gas. The lifecycle emissions of the gas that would be exported and burned by the LNG terminal are 32 million tonnes– equivalent to more than half of BC’s total annual emissions. If the LNG terminal goes ahead, it would produce enough emissions to undo literally everything BC has done to reduce emissions to date. In October 2023, the Rockies LNG Coalition signed a deal to support TC Energy’s plans to design and build the Prince Rupert Gas Transmission pipeline to transport fracked gas from northeastern BC to the proposed LNG facility on Pearse Island, with exports to Asia to supposedly start in early 2028. In November 2023, the Lax Kw’alaams First Nation, on whose territory the proposed pipeline would terminate, emphasized that it has not approved or consented to the Ksi Lisims LNG project or its Rockies LNG Partners. The First Nation remains steadfast in its opposition to the fracked gas project proceeding on Lax Kw’alaams territory.

Washington Gas

Deborah Stein sits on the board of Washington Gas, a wholly-owned subsidiary of AltaGas. Washington Gas is a utility that distributes fossil gas to 1.2 million customers in Washington D.C., Maryland and Virginia. The gas utility has pledged to be carbon-neutral by 2050, but lacks a credible plan to get there, and shows a troubling pattern of trying to lock its customers into continued fossil gas use while making false claims about the environmental impacts of gas. Despite the lower costs of renewable energy, heat pumps and energy efficiency and conservation, Washington Gas is spending millions of dollars to expand its gas business.

Washington Gas faces a lawsuit in Washington D.C. Superior Court over allegations the company is violating consumer protection law and greenwashing by marketing fossil gas as clean and sustainable. Source: Washington City Paper, February 1, 2023.

In Maryland, Washington Gas is spending $58 million on new gas business and expansion for its Maryland service territory, leading to higher bills for customers while contradicting the state’s climate goals and intention to electrify buildings. Maryland’s Office of People’s Counsel, a state agency that represents consumers, called Washington Gas’ gas infrastructure replacement and expansion plans “unreasonable and imprudent” strategies that failed to account for changing technologies, state climate policies, and the changing long-term economic prospects of the gas industry. Washington Gas is offering Maryland customers rebates if they buy new fossil gas appliances, such as gas water heaters and furnaces, in an attempt to keep customers hooked on gas rather than use more generous Inflation Reduction Act incentives to buy electric heat pumps that will reduce costs to heat and cool homes and buildings.

In Washington D.C., Washington Gas is seeking permission to raise customers’ prices to replace gas pipes, which would lock the U.S. capital region into using fossil gas for decades to come. Washington Gas’ proposal would increase customers’ monthly bills by an average of 20% and rates for some small business and commercial buildings by 30%. Washington D.C.’s Office of the People’s Counsel (OPC), the District’s Apartment & Office Building Association, the Sierra Club and the District government all opposed Washington Gas’ proposed rate hike. The OPC called it “an unconscionable burden to place on DC consumers at this time,” noting “despite significant capital expenditures over the past five years, WGL’s (the family company of Washington Gas) operational performance in terms of leak rates and pipe replacements has been substandard. WGL also failed to meet customer service quality standards for most of 2020 and 2021.” Washington Gas failed to provide D.C. regulators with concrete numbers demonstrating progress on curbing emissions or plans for future reductions. D.C.’s Office of the Attorney General said “WGL has consistently failed to align itself with the District’s goals. The company is not appropriately planning for the District’s decarbonized future, which will see a reduction in demand for fossil gas and the gas pipelines… Ratepayers overall should not be on the hook for the risks a utility creates for itself by failing to respond to policy changes.” D.C.’s Department of Energy and Environment said that Washington Gas’ Climate Business Plan is “riddled with significant technical deficiencies,” “fails to include an actual business plan,” and ignores the District’s policy goals around switching away from fossil fuels. A local residents’ group, the Chesapeake Climate Action Network, said that “Investment in pipe replacement, especially where it is not needed, across the city is a huge misdirection of ratepayer money. It’s irresponsible, and it has extremely detrimental health and climate impacts.”

Three advocacy groups filed a lawsuit against Washington Gas in D.C. Superior Court in July 2023, alleging the company is violating consumer protection law and greenwashing by marketing fossil gas as clean and sustainable.

In Montgomery County, Maryland, Washington Gas worked to block a bill to ban fossil gas in new buildings by the end of 2026, while Washington Gas lobbyists tried and failed to neuter a significant piece of climate legislation in Washington, D.C. that would force the local government to immediately meet net-zero standards and ban fossil gas. Washington Gas also lobbied to fight an imminent ban on gas stoves in new construction in Montgomery County, Maryland.

The Maryland Office of People’s Counsel is taking legal action against Washington Gas for deceiving its customers by falsely claiming that fossil gas is cleaner than electric power and undermining the state’s goal to reduce greenhouse gas emissions. Environmental groups supported the legal action, arguing that Washington Gas provided false information to customers about the environmental impacts of fossil gas.

In Fairfax County, Virginia, Washington Gas is fighting a legal battle against residents in an attempt to install a new fossil gas pipeline through the community. Washington Gas also donated $22,000 to a Republican in Virginia’s House of Delegates, who then introduced a bill that prevented the state from banning fossil gas hook-ups in new buildings.

Washington Gas is a member of the American Gas Association (AGA), the lobby group for the US fossil gas industry. The President of Washington Gas sits on the AGA’s Board of Directors. The AGA is working to discredit research on the health impacts of gas stoves and waging state and city lobbying campaigns against initiatives to replace gas appliances with electric devices– despite knowing about the health and environmental impacts of gas five decades ago.

Trican Well Service

Deborah Stein sits on the board of Trican Well Service, a Calgary-based fracking and oilfield services company. Trican is the “largest pressure pumping service company in Canada and provides a comprehensive array of specialized products, equipment and services that are used during the exploration and development of oil and gas reserves.” Trican has not made a net-zero emissions commitment.

Trican Well Service “Talking Oil & Gas” document that provides employees with misleading talking points to promote fracking.

Trican first committed to setting emissions reduction targets in its 2020 Sustainability Report. In its 2021 Sustainability Report,Trican said “in 2022, we are evaluating setting ambitious targets for emissions reductions and energy efficiency.” Trican still has not set emissions reduction targets. The company’s scope 1 and 2 emissions both increased between 2021 and 2022 (2022 Sustainability Report, the last year for which reporting is available).

Trican considers “carbon taxes and other proposed emissions reduction targets to meet net-zero by 2050” to be a material risk to its operations and financial performance (2021 Sustainability Report).

Trican lists its membership with the Energy Services Association of Canada (Enserva), “who advocates on behalf of Trican” (2021 Sustainability Report). Enserva is the industry association for the services, supply and manufacturing sectors of the Canadian energy industry whose vision is to “unlock Canadian energy to make the world a better place.”

Trican’s “Environmental, Social and Governance” webpage includes a “Talking Oil & Gas” toolkit that informs employees how to “respond to some of the concerns being expressed by your friends, family, on the news, and sometimes by colleagues” about the fracking industry. The document includes misleading talking points about the impact of fracking on land, water, air, health and the environment. It also claims that “both oil and natural gas are cheaper, easier to transport and more reliable than renewable resources such as wind and solar.” The document does not mention climate change, while wind and solar have been the cheapest source of new energy since 2020 and have proven to be pivotal in preventing power outages during recent extreme weather events.

Parkland Corporation

Deborah Stein sits on the board of Parkland Corporation, one of the largest independent fuel and petroleum service companies in Canada, which owns fuel storage and distribution terminals and gas stations across North America and a refinery in British Columbia. Parkland has not made a net-zero emissions commitment.

On a positive note, Parkland operates some electric vehicle (EV) charging stations and develops some low-carbon fuels. In November 2023, it secured up to $210 million in financing from the Canada Infrastructure Bank (CIB) to support the growth of its EV charging network. The CIB is de-risking the expansion of Parkland’s EV network by funding up to 80% of capital deployed to install the chargers over four years.

However, Parkland continues to develop its “existing business” (petroleum refining and gas stations) in places where it “expect(s) long-lasting customer demand.”

Parkland’s Burnaby Refinery provides 25% of BC’s gasoline and diesel and 30% of Vancouver International Airport’s jet fuel. Parkland has 4,000 retail fuel locations across Canada, the United States and the Caribbean, through gas station brands such as Ultramar, Pioneer and Chevron. After announcing a landmark sustainability plan in 2021, Parkland abandoned its plan to build a renewable diesel complex at its Burnaby refinery in March 2023.

In December 2023, Parkland joined a group of oil companies, including Canadian Natural Resources Ltd., Marathon Petroleum, Suncor Energy and PetroChina Canada Ltd., in writing a letter to the Canada Energy Regulator calling for the timely completion of the TransMountain Expansion, which is designed to transport 890,000 barrels per day of diluted bitumen from the tar sands to the BC coast until 2075.

Parkland is an associate member of CAPP.