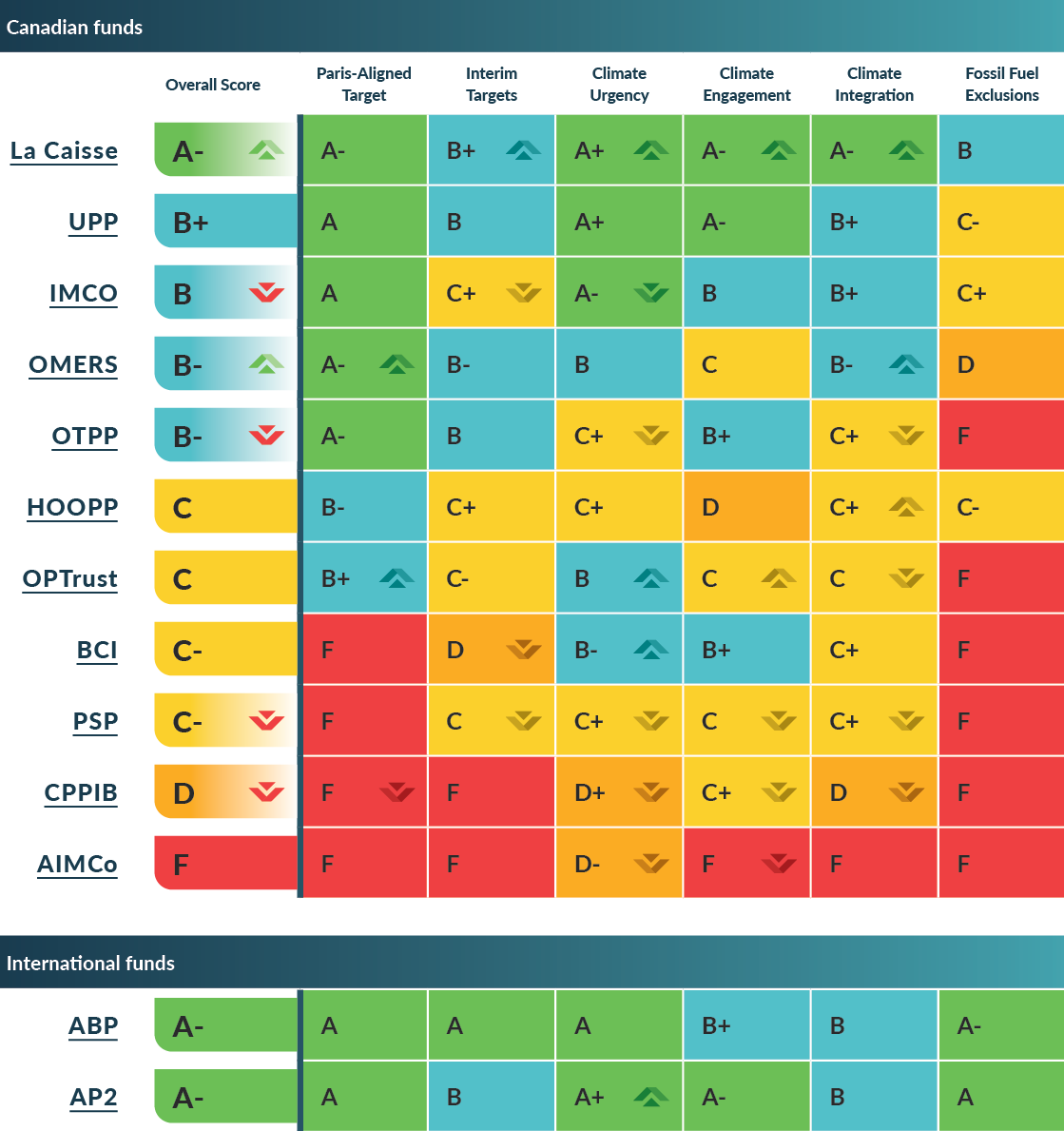

2025 Canadian Pension Climate Report Card

Shift’s fourth annual Canadian Pension Climate Report Card, released January 28, 2026, analyses the climate policies of Canadian pension funds based on public information disclosed to December 31, 2025.

Register here to join our webinar about the report card findings on Thursday, February 26, 2026 at 12pm ET.

Shift’s annual Canadian Pension Climate Report Card is an independent benchmark for evaluating the quality, depth and credibility of climate policies and strategies for 11 of Canada’s largest pension managers.

With a collective $2.7 trillion in assets under management, these pension funds play a critical role in shaping Canadians’ exposure to climate-related financial risk. Credible strategies to align pension portfolios with a safe climate are not optional – they are required to meet fiduciary obligations, as minimizing global temperature rise will result in the strongest long-term financial outcomes for plan members.

This fourth edition reveals a stark and widening divide across Canada’s pension sector. While climate leaders are advancing ambitious strategies, scaling up climate investments and embedding climate risk into portfolio decisions, backsliders are going quiet on climate, retreating from commitments and expanding fossil fuel exposure.

For interview requests, questions or comments, please contact info@shiftaction.ca.

Dive into Each Pension Manager’s Climate Scores

Click on your pension fund for a detailed analysis of its climate scores.

For the Canada Pension Plan, select CPPIB.

(Need help finding your pension fund’s acronym? See here.)

Read the Report

Click to download the report, read the summary report and media release, view the methodology, or register to join the webinar.

Report cover image credit: Jim Peaco / National Park Service.

View the Report’s Tables

Your Voice Matters

Tell your pension fund what you expect.

Your pension savings are invested on your behalf – and your pension managers need to hear from you. Let them know that you care about how your retirement savings are managed and that you expect them to be invested in ways that support a safe, stable climate.

Pension fund managers have a fiduciary duty to act in members’ best long-term interests. That means protecting your retirement security in a world that limits global heating to 1.5°C. Use your voice to urge your pension fund to strengthen its climate approach and manage climate-related risks responsibly.

Write to your pension manager today and make your expectations clear.