Climate Pension Quarterly - Issue #12

As Canadians bake in 40°C, their pension funds inch toward fossil fuel exclusions

Ontario, Quebec and New Brunswick are suffering through feels-like-40°C temperatures in June as this edition of the Climate Pension Quarterly arrives in your inbox. The oppressive heatwave, which the federal environment ministry is now able to attribute to human-induced climate change, is passing the costs of continued fossil fuel expansion on to children sweating through classes, workers gulping down water to avoid heat stress on the job, and seniors struggling to stay cool in homes without air conditioning.

There’s no dignified retirement on a burning planet

In April, Generation Investment Management, an investment firm founded by climate hawk Al Gore, spelled out a truth that’s on the minds of most of the pension plan members we hear from at Shift:

“A pensioner living in a 3.0°C hotter world, with degraded ecosystems and significant economic inequality, will not enjoy the fruits of their retirement.”

Pension funds must acknowledge that investing in the primary cause of the climate crisis jeopardizes their own members’ long-term health and quality of life.

The financial case for fossil fuel investments is also crumbling, as summed up by investor Tom Steyer this spring:

“Today, an institutional investor that backs new fossil fuel projects is betting that our addiction to fossil fuels will go on forever. Even if all I cared about was financial responsibility to my shareholders, I wouldn’t make that bet.”

A rampantly inefficient fossil fuel energy system is on its way out

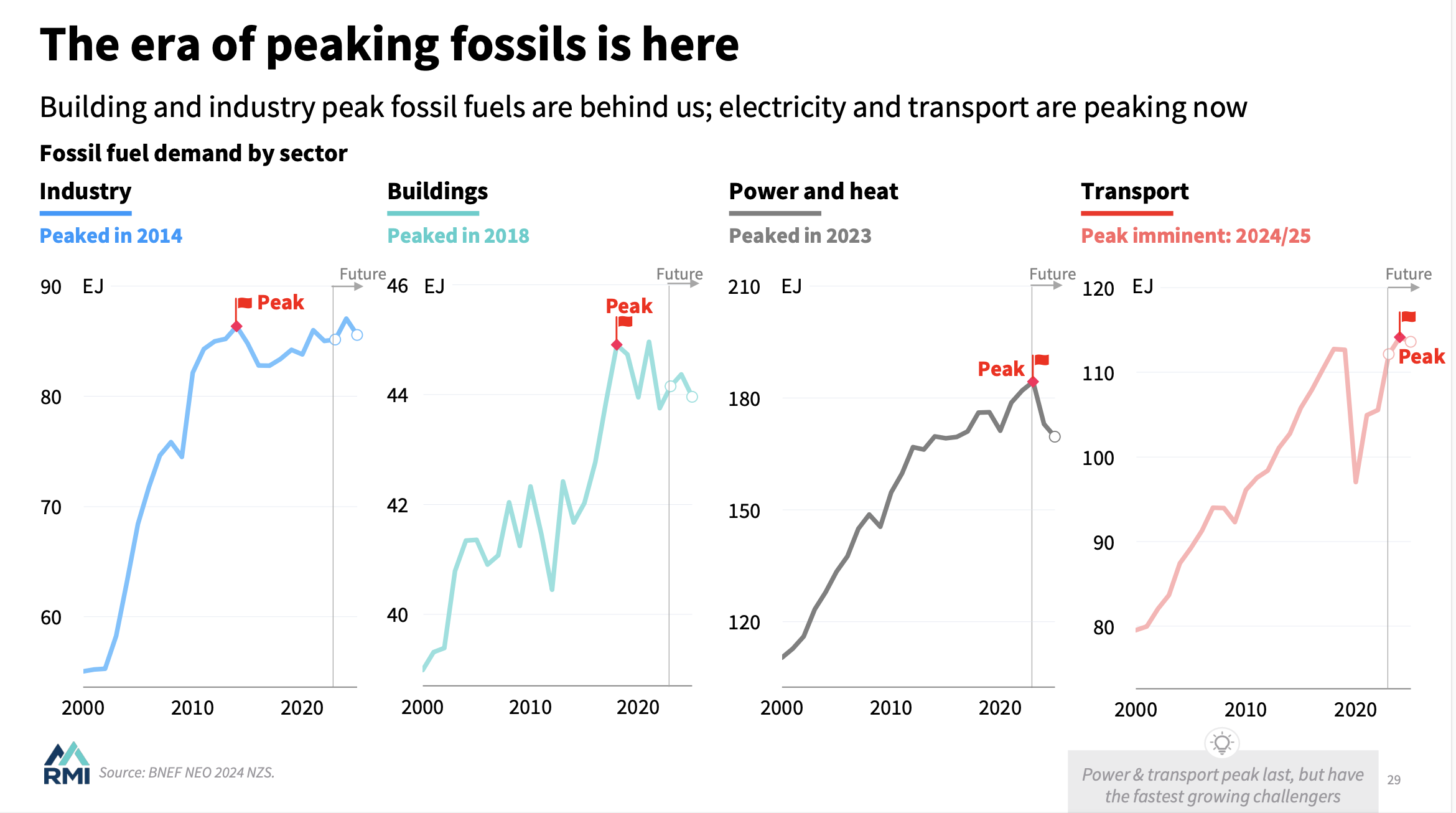

Research this quarter from the International Energy Agency (IEA) and the Rocky Mountain Institute (RMI) forecast the inevitable decline of the “rampantly inefficient” fossil fuel energy system. According to RMI’s June report, the fossil-based global energy system results in almost two thirds of all primary energy being wasted, demonstrating how vulnerable fossil fuels are to being undercut by more efficient sources and uses of energy. The report showed that fossil fuel demand from the industry and buildings sectors has already peaked, and is peaking now for power, heat and transport. Meanwhile, the IEA’s June report warned oil companies to prepare for global demand for oil to peak in 2029 (a year ahead of its previous prediction), and for significant oversupply beginning in 2030.

Canadian pension funds beginning to recognize the risks

Despite their reluctance so far to publicly acknowledge that a dignified retirement for their beneficiaries requires a wind-down of fossil fuel production, some Canadian pension funds are beginning to recognize the financial risks of investing in a dying industry that’s jeopardizing life on Earth. In annual reports issued this quarter, the Healthcare of Ontario Pension Plan said it had made no new direct investments in coal or oil in 2023, the Investment Management Corporation of Ontario acknowledged that the world is moving away from “traditional energy sources”, and the Caisse de dépôt et placement du Québec proudly told its beneficiaries:

“[W]e have taken decisive action, including completing our exit from oil production and coal mining; we no longer want to contribute to the supply of these two types of energy, which are not energies of the future. To preserve the long-term value of our assets, we have positioned them advantageously by limiting their exposure to climate and transition risks.”

Pressure from the pension public

Pension plan members want their fund managers to get clear about the unavoidable relationship between long-term financial value, retirement security and fossil fuel wind-down. In May, faculty and staff at the University of Toronto called on Ontario’s University Pension Plan to announce a rapid timeline for eliminating its exposure to the high-risk oil and gas industry. And in June the city council for Cornwall, Ont., passed a resolution requesting that its mayor call on OMERS to withdraw from or phase out its existing fossil fuel assets.

Pension members also spoke up so that their pension funds would hold companies accountable for providing credible, decision-useful climate information to investors. Canadians from coast to coast used Shift’s action tools to send emails to their pension funds asking them to vote for better climate disclosure from Toronto-Dominion Bank, Royal Bank of Canada and Enbridge. The British Columbia Investment Management Corporation, Caisse de dépôt et placement du Québec, Investment Management Corporation of Ontario and Ontario’s University Pension Plan voted in line with the relatively strong climate expectations they’ve set out in their proxy voting guidelines. Votes from the Alberta Investment Management Corporation and Canada Pension Plan Investment Board were more concerning, with both failing to vote for oil and gas pipeline company Enbridge to fully account for the emissions that will result when its customers use the fossil fuels that flow through its pipelines. Read on for more in this Quarterly’s recap of the 2024 shareholder season.

After another round of failed climate engagement with Enbridge, will Canadian funds realize that climate engagement with the fossil fuel sector is futile?

International pension funds are starting to understand this: California Public Employees' Retirement System board members admitted that “engaging” Exxon won’t work and chose to vote against Exxon directors after the company slapped investors with a lawsuit for bringing forward a climate-related proposal. And Europe’s largest pension fund, ABP, exited oil, gas and coal investments, saying that the step is necessary “after efforts to engage with fossil fuel producers and get them to reduce their greenhouse gas emissions proved ineffective.”

Once again, the Canada Pension Plan Investment Board refused to get the memo, with its portfolio companies expanding oil and gas production even as a Harvard Business School case study about the fund suggests that some of its stakeholders and employees are uncomfortable with the pension manager’s approach to fossil fuel assets and existential climate risks. Read our latest CPPIB Watch for this quarter’s updates on the fossil fuel companies in which our national pension manager has invested our retirement savings.

This issue of the Climate Pension Quarterly catches you up on:

Climate highlights from the annual reports of seven pension funds;

Renewable energy investments from the Canada Pension Plan Investment Board, Healthcare of Ontario Pension Plan, Ontario Teachers’ Pension Plan and Caisse de dépôt et placement du Québec

Increasing stranded asset and/or greenwashing risk for gas distribution networks owned by the British Columbia Investment Management Corporation, Ontario Teachers’ Pension Plan, PSP Investments and Alberta Investment Management Corporation;

Updates on Canadian pension fund-owned companies including Thames Water, Puget Sound Energy, Northvolt, TriSummit Utilities and Aethon Energy.

The full stories are available here in pdf form.

-Adam Scott, Executive Director, Shift

P.s. This month, Shift welcomed Kevin Philipupillai to our team as Program Manager (Research Lead). Kevin comes to Shift after 12 years as a journalist, most recently covering Canadian federal politics and the energy transition as a member of the Parliamentary Press Gallery. As a Master's student at Carleton University, he specialised in collaborative investigations and in tracking the movements of institutional investors. Born in Singapore and now based in Ottawa, Kevin is ready to play a more active role addressing the climate crisis and legacies of environmental racism. He looks forward to bringing you future editions of the Quarterly and leading the development of next year’s Canadian Pension Climate Report Card. Welcome, Kevin!