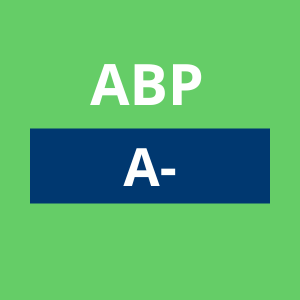

British Columbia Investment Management Corporation (BCI)

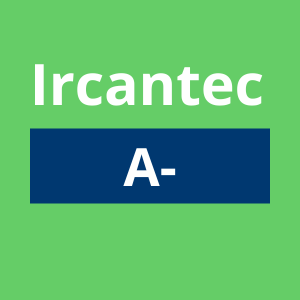

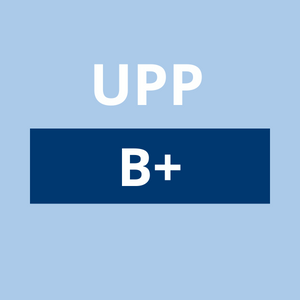

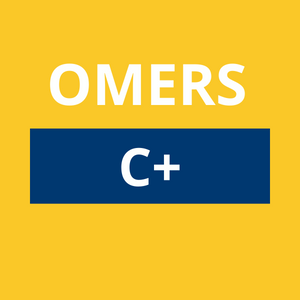

The 2023 Canadian Pension Climate Report Card assesses large Canadian pensions on their management of climate-related risks. The report is based on publicly available information to December 31, 2023.

BCI is the investment manager for over 725,000 members of British Columbia’s public pension plans, including the Municipal Pension Plan, Public Service Pension Plan, Teachers’ Pension Plan, College Pension Plan, BC Railway Company Pension Plan, WorkSafeBC Pension Plan, BC Hydro Pension Plan and staff and faculty pension plans at the University of Victoria and University of British Columbia. BCI also manages insurance and benefit funds for over 2.5 million workers and retirees in British Columbia.

Assets Under Management (AUM): $233.0 billion (March 31, 2023)

While BCI has a relatively robust approach to climate engagement, the investment manager falls short of being a climate leader. BCI has not yet committed to achieve net-zero portfolio emissions and has industry-lagging and incomplete interim targets. The investment manager has not yet placed any exclusions on fossil fuels nor has it explained how its existing fossil fuel assets have credible, profitable net-zero pathways.

In 2023, BCI:

Strengthened its proxy voting guidelines, including calling for companies to integrate climate assumptions and risk evaluations into their audited financial statements and stating that it would vote against directors for inadequate disclosure of climate-related financial risks or lacking a strategy to manage climate risks.

Became the first large Canadian public sector pension investment manager to file a climate-related shareholder proposal. BCI proposed that Imperial Oil provide a financial assessment of the company retiring its fossil fuel assets in line with a net-zero by 2050 emissions pathway.

Reported $4 billion in sustainable bonds, on the way to $5 billion by 2025.

Reported a 24% reduction in the emissions intensity of the public equities portfolio.

Increased its joint stake in National Gas, the UK’s fossil gas transmission system, to 80%.

BCI discloses more information than many of its Canadian pension peers, including publishing its investment inventory, an itemized list of companies engaged on Environmental, Social, and Governance (ESG) factors and BCI’s role in those engagements, and directorships/trusteeships held by directors within the last five years.

2023 UPDATES

None. BCI remains one of just three pension managers analyzed in this report that has yet to commit its portfolio to net-zero emissions by 2050 or sooner.

DETAILS

While acknowledging that “stabilizing climate change and achieving net-zero emissions globally by 2050 must occur to mitigate its most severe physical and economic impacts,” BCI has yet to commit to aligning its portfolio with the goals of the Paris Agreement (2022 ESG Report, p.9). BCI instead states the intention to "[use] our influence to drive actions aligned with the global goal of achieving net-zero greenhouse gas emissions by 2050" (p.9). This same wording is reiterated in BCI's 2022 Climate Action Plan and its 2022-2023 Corporate Annual Report.

While BCI has yet to commit its portfolio to net-zero emissions, the BCI-managed Municipal Pension Plan set a net-zero emissions by 2050 target in November 2022.

2023 UPDATES

BCI remains one of the few pension managers analyzed in this report that has not yet set interim emissions intensity reduction targets, beyond a target announced in 2021 to reduce the carbon intensity of its public equities portfolio.

Reported 24% reduction in emissions intensity of public equities portfolio, below 2019 levels.

Reported over $4 billion invested in sustainable bonds, on the way to BCI’s target of $5 billion by 2025.

DETAILS

In the absence of a long-term target for Paris alignment, BCI’s interim targets lack consistency, contain loopholes and make it difficult to hold the pension manager accountable.

Emissions reduction targets

BCI has just two targets to reduce emissions: an intensity-based target in its public equities portfolio, and an absolute target in its real estate portfolio.

The investment manager committed in 2021 to reduce the emissions intensity of the public equities portfolio, representing 28.3% of AUM as of March 31, 2023, by 30% below 2019 levels by 2025. In its 2022-2023 Corporate Annual Report, BCI reported a 24% intensity reduction in the public equities portfolio (p.86).

BCI’s real estate portfolio, representing 15.5% of AUM and independently managed by BCI’s real estate subsidiary QuadReal, has an interim target to reduce the absolute emissions of its global real estate holdings 50% by 2030 on the way to net-zero by 2050.

Regarding its overall portfolio carbon footprint, BCI merely expresses an “expectation that it will decrease over time” (2022 Climate Action Plan, p.11).

Portfolio companies with net-zero commitments

In its 2022 Climate Action Plan, BCI announced a weak commitment to ensure that 80% of its carbon intensive investments, defined as the approximately 90 companies that make up over 80% of BCI’s portfolio carbon footprint, have “set mature net-zero aligned commitments by 2030, or are the subject of direct or collaborative climate engagement by BCI” (p.5). This suggests that BCI could continue investing in high-risk fossil fuel companies in 2030 and beyond, even if another seven years of engagement efforts fail to achieve climate alignment.

Sustainable bonds investment

While BCI has not yet made a commitment to a total percentage of AUM invested in climate solutions, BCI committed in 2021 to achieve $5 billion in sustainable bonds by 2025. As of the April 2023 release of its 2022 ESG Report, BCI reported $4 billion invested (p.33).

2023 UPDATES

No updates.

DETAILS

BCI’s Task Force on Climate-Related Financial Disclosures (TCFD) Report (included in BCI’s 2022-2023 Corporate Annual Report) demonstrated that the investment manager sees its role in managing climate-related risks as trying to mitigate long-term negative economic outcomes through engagement of public companies and advocacy for public policy and regulations. It also states that BCI has essentially given up on the world achieving the goal of limiting global heating to 1.5°C and is not preparing its companies for a 1.5°C future.

Sample language from BCI’s 2022-2023 Corporate Annual Report (p.79):

“Over the long term, an orderly transition to a low-carbon economy that is aligned with a net-zero (1.5°C) scenario will ultimately benefit client portfolios. However, we do not see an indication that current global government commitments will meet that goal. BCI’s engagement and advocacy efforts will continue to focus on supporting public policies and regulations that enable an orderly and predictable transition and prepare companies to be resilient under any transition.”

Sample language from “Our Net-Zero Statement” in BCI’s 2022 Climate Action Plan, (p.4):

“The negative financial impacts to the economy increase with every tonne of GHG emitted, which is why we support actions that limit GHG emissions wherever possible. Climate change is recognized as a key financial risk by governments and regulators, who will influence how the financial system accounts for climate-related risks going forward. It is imperative to BCI acting in our clients’ best financial interest to consider this systemic financial risk across all time horizons, and ensure we are working to achieve the best possible financial outcomes for our clients.”

While BCI is acknowledging climate change’s systemic impacts and the “negative financial impacts” of “every tonne of GHG emitted”, BCI fails to acknowledge that its own investment decisions and the stewardship and decarbonization of its own assets can affect the stability of the climate.

2023 UPDATES

Strengthened Proxy Voting Guidelines for 2023, including a new requirement that publicly traded companies incorporate climate assumptions and risk assessments into their audited financial statements.

Filed a shareholder proposal that called on Imperial Oil to enhance its disclosure on climate risk, including asking for an audited financial statement on the costs of retiring Imperial Oil’s fossil fuel assets.

Made a joint submission (alongside University Pension Plan, Canada Post Corporation Pension Plan and other investors) to Environment and Climate Change Canada regarding the federal oil and gas emissions cap that encouraged the government “to adopt the most practical and effective regulatory changes, in order to incentivize emission reduction innovation and implementation to further limit climate change and to reduce systemic risk in our portfolios.”

SUMMARY

BCI discloses more details of its climate engagements than most Canadian pension managers, and is an active participant in Climate Action 100+. However, BCI needs to strengthen expectations-- including by setting its own net-zero target-- that its owned companies have a credible net-zero pathway, and needs to strengthen its climate-related guidelines for external managers. BCI has opened the door to “selectively divest[ing]” in response to “critical ESG issues” or when companies respond insufficiently to material business risks, including ESG risks (2022 ESG Report, p.10). This appears to be a shift from BCI’s previous statements that divestment is not an effective strategy.

DETAILS

Expectations for owned companies

BCI's modest commitment to having 80% of its "carbon-intensive" investments either establish net-zero-aligned commitments by 2030 or become subjects of climate engagement conveys some expectations to the companies it owns. However, these expectations are relatively lenient, as companies are granted until 2030 to comply, and even then they face no consequences other than continued engagement if they fail to make progress.

In its Infrastructure & Renewable Resources portfolio, which contains fossil gas pipeline companies, oil and gas producers and fossil fuel power generation assets, BCI has not demonstrated how its ownership of and influence over private companies has led to climate alignment. In contrast, BCI’s ability to exert positive ESG influence on its owned companies is in question, considering the track record of one of its private investments. The UK utility Thames Water, of which BCI holds a 9% stake, finds itself burdened with substantial debt, incapable of funding essential operations and crucial infrastructure upgrades, and faces scrutiny and fines for multiple environmental violations.

Direction given to partners and external managers

BCI assesses its private equity partners and external managers on ESG, with its assessment results indicating that 57% of partners have “strong” ESG practices, and 42% have “average” practices (2022 ESG Annual Report, p.15). But BCI does not disclose any specifics related to how it screens these partners and managers on ESG or climate.

Proxy voting

Although BCI's Proxy Voting Guidelines still do not state the expectation that companies establish credible net-zero pathways, BCI took steps to enhance its guidelines in 2023. This included the introduction of a new requirement that publicly traded companies incorporate climate assumptions and risk assessments into their audited financial statements.

In 2022, BCI voted for climate-related reasons against 261 directors within 197 companies, compared to 51 directors at 34 companies in 2021. These votes were driven by BCI’s guideline to consider votes against directors for “a weak response to climate change risk or inadequate disclosure” (BCI ESG Report 2022, p.28).

An analysis by Shift of a sample of climate-related votes at Canadian companies in 2023 showed that BCI supported seven of eight shareholder proposals. An analysis by Investors for Paris Compliance of BCI’s 2022 climate-related proxy voting record indicated that the investment manager did not consistently vote in support of resolutions flagged by Climate Action 100+, although BCI did vote in favour of more flagged resolutions than it opposed and consistently provided rationales for its decisions. When voting against a resolution, BCI generally stated that the proposal was overly prescriptive. However, BCI's proxy voting policy has allowed support for more prescriptive climate-related shareholder resolutions since 2021.

Collaborative engagement

BCI’s 2022 ESG Report updated beneficiaries on the investment manager’s engagements with ExxonMobil, one of the world’s biggest carbon emitters, stating that its collaborative engagements since 2017 “delivered some results,” but that “large gaps in climate disclosure remain a concern.”

“At ExxonMobil’s 2022 Annual General Meeting (AGM), BCI supported a shareholder proposal calling for an audited report assessing how the International Energy Agency’s net zero by 2050 pathway assumptions affect the underlying inputs of the company’s financial statements. While the proposal passed, ExxonMobil has not provided sufficient information for shareholders to assess the financial impact of the energy transition. As a result, BCI co-filed a proposal in 2023 with two lead investors, calling on the company to report the impact of climate assumptions and net-zero scenario analysis on its financial accounting for asset retirement obligations” (p.22).

BCI filed the same proposal at Imperial Oil, Exxon Mobil’s Canadian subsidiary, stating that its proposal was “the first climate-related shareholder proposal filed by a large Canadian public sector pension investment manager” to go to a vote at a Canadian company.

BCI deserves recognition for filing these proposals and reporting on them publicly. In the case of Imperial Oil, it is notable that no other Canadian pension fund is applying such direct and public pressure on one of Canada’s biggest climate polluters. However, Imperial Oil and other oil and gas companies continue to expand production and undermine ambitious climate policy. BCI must recognize that when it comes to companies with business models that depend on the extraction of fossil fuels, engagement is a dead end.

BCI backed the Carbon Disclosure Project’s 2023 Science-Based Targets (SBT) Campaign, which calls on more than 2,100 high-emitting companies to set emissions reduction targets. While this demonstrates BCI’s use of its influence to support the setting of science-based targets, BCI must demonstrate that it too will align with climate safety by making its own science-based net-zero commitment.

Other: Climate Finance Project with the University of Victoria (UVic) and the Pacific Institute for Climate Solutions

BCI is a partner in a three-year research project to “develop decision-making tools and frameworks for integrating climate change risk evaluation and climate mitigation opportunities into clients’ investment portfolios” (2021 ESG Annual Report, p.42). This year, BCI stated that it used the research on industry classification standards from this project to expand its Risk and Opportunity Framework (2022 ESG Report, p. 13).

2023 UPDATES

BCI named its first global head of ESG and expanded its ESG team.

In 2022-2023, BCI continued to add fossil fuel assets to the Infrastructure and Renewable Resources portfolio but did not explain how these assets could be decarbonized, despite having committed in its 2021 ESG Report to developing a plan to decarbonize this portfolio.

BCI’s inclusion of fossil fuel infrastructure alongside renewable investments in this portfolio obscures stakeholders’ ability to determine the extent of fossil fuel assets in the portfolio.

DETAILS

Accountable Paris-aligned membership

BCI is not a member of any accountable and credible Paris-aligned investor body.

Transparency and disclosure of holdings

No pension fund or investment manager examined in this analysis disclosed both a list of its high-carbon assets and their associated value. BCI, however, does provide an annual Investment Inventory, which lists all of its investments and private equity partners, as well as the value of its investments in public markets. BCI also provides in its 2022 ESG Report better-than-average disclosure of its public company engagements and discussion of select engagements via Climate Action 100+. The fund also posts on its website accessible and searchable disclosure of its regulatory submissions and comments.

However, BCI has at times been less than forthcoming about its acquisition of fossil fuel assets. When BCI first announced in 2022 that it would acquire a joint 60% stake in National Gas, it asserted that the investment aimed to contribute to "delivering a hydrogen ‘backbone’ for Britain," fostering the "decarbonization of power generation and heavy industry," and supporting the UK's commitment to achieve net-zero carbon emissions by 2050. This announcement was met with criticism and disbelief by some climate experts: despite BCI's confidence in hydrogen's potential for Britain's gas pipeline network and home heating, a substantial body of evidence suggests that converting gas pipeline networks for hydrogen transport is economically unviable, impractical, and potentially hazardous. Investing in a fossil gas company with ill-conceived hydrogen schemes is neither financially prudent nor aligned with climate safety. When BCI increased its joint stake in National Gas by 20% in National Gas, the investment manager did not make a public announcement.

Transparency and disclosure of climate risk

While BCI highlights its investments in renewable energy, sustainable bonds and other climate solutions, the investment manager’s 2022 ESG Report contains no information on the significant fossil fuel infrastructure in BCI’s Infrastructure & Renewable Resources portfolio. BCI’s 2021 ESG Report claimed that it is developing a plan to decarbonize this portfolio, but the 2022 ESG Report provides no details beyond stating that the Infrastructure & Renewable Resources team “increased its scrutiny of climate targets [and] transition plans” (p.12) and will “continue advancing [its] decarbonization plans to mitigate risk and create value for [its] clients” (p.43).

BCI continued to provide disclosure of how it incorporates climate risk into its investment analysis through its climate-focused ESG Risk and Opportunity Framework, including incorporating research from the collaborative Climate Finance Project (2022 ESG Report, p.13, 17). BCI uses this framework to analyze climate-related physical and transition risks and stress test the portfolio using 1.5°C, 2°C, and 3°C warming scenarios. According to its assessment, BCI concluded that the portfolio’s “climate change risk level” has decreased: BCI estimated that in 2018 the portfolio would have experienced a -6.4% net loss based on its exposure to climate-related risks; as of 2022 BCI put this estimate at -5.2% (p.13). The investment manager’s discussion of different warming scenarios, their impacts on different sectors, and the short, medium and long term physical and transition risks facing the portfolio is more detailed than what many other pension managers have disclosed (2022-2023 Corporate Annual Report, pp.79-81). BCI also helps its client funds understand climate-related risk by using its scenario analysis and ESG Risk and Opportunity Framework to explain the economic impacts of the climate crisis and inform Asset-Liability Modelling reviews (2021 ESG Annual Report, p.9).

BCI’s most recent update to its Climate Action Plan was in November 2022, with progress reported in the investment manager’s 2022 ESG Report.

Climate risk expertise

According to BCI’s 2022 ESG Report, BCI expanded its ESG staff to 16 people, naming its first global head of ESG and hiring “additional senior ESG experts” (p.5). It is not clear what percentage of BCI’s ESG team is specifically focused on climate issues.

Board climate expertise and/or fossil fuel entanglement

BCI has not disclosed a Board competencies and experience matrix. None of BCI’s Board members are identified as having climate expertise, although BCI has reported on climate education for Board members. The 2021 ESG Report indicated that the Board received education on climate-specific issues, as well as a briefing of how BCI integrates climate change into its decision-making processes (p.46). No further information was provided in 2022.

None of BCI’s Board members appear to have fossil fuel entanglements.

Executive and staff compensation and climate

BCI’s submissions to the United Nations Principles for Responsible Investment indicate that at least some staff have variable compensation linked to responsible investment performance (Public Transparency Report, pp.36-38), but there is no specific evidence provided elsewhere detailing if and how BCI has linked its executive and staff compensation to the achievement of climate related targets.

2023 UPDATES

None.

DETAILS

BCI has placed no exclusions on new investments in coal, oil, gas or related infrastructure and has announced no intention to phase out fossil fuel assets.

BCI’s 2022 ESG Report states that “Technological breakthroughs and business model adaptation require capital to achieve emissions reduction. An unintended consequence of broad-based divestment is starving hard-to-abate sectors of capital, such that they are unable to transition.” BCI must make a distinction between hard-to-abate sectors that do have technological pathways to transition, and fossil fuel companies, which do not.