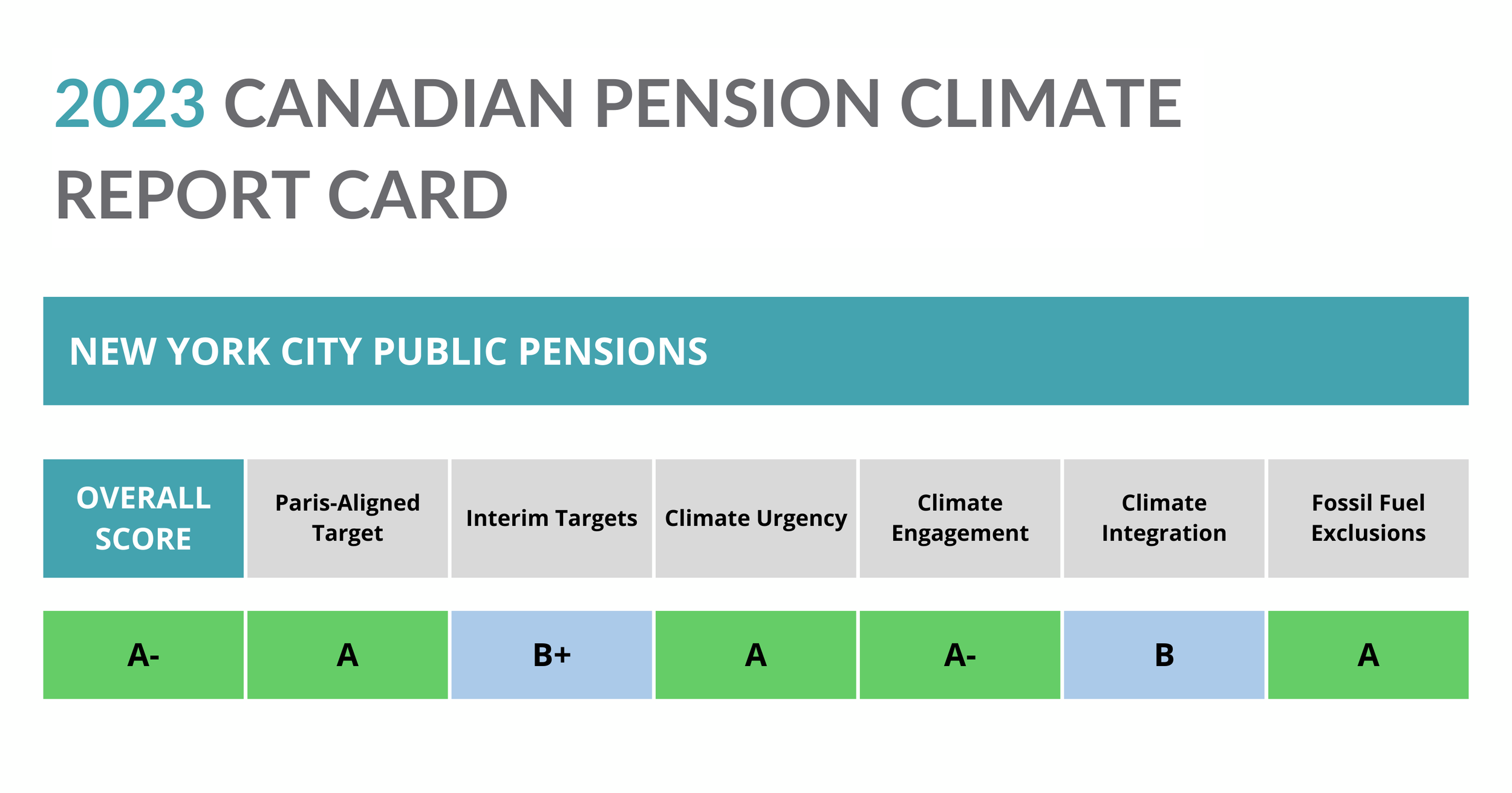

New York City Public Pensions

The 2023 Canadian Pension Climate Report Card assesses large Canadian pensions on their management of climate-related risks. For comparison, the report also includes analysis of three international funds: ABP (Netherlands), Ircantec (France), and New York City Public Pensions (United States). The report is based on publicly available information to December 31, 2023.

The New York City Comptroller (or “NYC Comptroller”) is the custodian for five New York City Public Pension Funds, three of which — New York Employees’ Retirement System (NYCERS), New York City Board of Education Retirement System (BERS), and New York City Teachers’ Retirement System (TRS) — have committed to achieve net-zero portfolio emissions by 2040.

NYC Comptroller Assets Under Management (AUM): US$242 billion (October 31, 2023)

Combined AUM for TRS, NYCERS, and BERS: US$176 billion (October 31, 2023)

The NYC Comptroller has taken a leadership role among investors, championing the need for investor action on climate and in many cases leading by example. The Comptroller reports details on expectations-based engagements with focus companies, brings forward shareholder resolutions, and advocates for climate-aligned policy.

The NYC Comptroller’s transparency is notable: the public can access dashboards to view investments across the pension systems and to view progress against different climate targets.

Three New York City pensions (NYCERS, TRS, and BERS) have committed to achieve net-zero portfolio emissions by 2040, and are on track to meet their interim 2025 and 2030 targets. NYCERS, TRS, and BERS have divested US$3.8 billion from fossil fuel reserve owners. The funds now must enact their recently adopted Net Zero Implementation Plans, and must also incorporate scope 3 emissions and define targets for absolute emissions reductions. The NYC Comptroller must work to align the Police and Fire Department pension funds to credible net-zero goals.

The three NYC pensions have committed to achieve net-zero emissions in their portfolios by 2040, a decade earlier than most investors' net-zero goals, and including scope 1, 2 and 3 emissions. While so far the funds’ interim targets include just scope 1 and 2, they have committed to set Scope 3 targets starting in 2025. The pensions place a clear emphasis on prioritizing real-world emissions reductions:

“[We] will seek to support real economy emissions reductions by increasing the alignment of our investments with science-based pathways to limit global warming to 1.5°C. … To be clear, we seek real world decarbonization, not just portfolio decarbonization, and we will not rely on the sleight of hand of poor-quality carbon offsets to appear to lower our carbon footprint” (NYCERS/TRS/BERS Net Zero Implementation Plans, pp.10, 12.)

Each pension has published a detailed implementation plan, laying out climate disclosures, investment strategies and specific time-bound targets requiring portfolio companies to have science-based targets.

NYCERS, BERS and TRS are members of the Paris Aligned Asset Owners.

Emissions reduction

The NYC pensions have each set 2025 and 2030 interim portfolio emissions reduction targets for public equities and corporate bonds, inclusive of scope 1 and 2 emissions, using a 2019 baseline (NYCERS/TRS/BERS Net Zero Implementation Plans, p.8). Public equities and corporate bonds amount to 70%-78% of each pensions’ AUM as of November 2023 (Pension/Investment Management: Assets Under Management, NYC Comptroller webpage).

NYCERS and TRS have each committed to a 32% reduction in portfolio emissions intensity by 2025 and a 59% reduction by 2030. BERS has committed to a 22% reduction in portfolio emissions intensity by 2025 and a 49% reduction by 2030.

The funds intend to develop interim targets for private markets and other asset classes and plan to begin including scope 3 emissions in the coming years, although a timeline is not provided (NYCERS/TRS/BERS Net Zero Implementation Plans, pp.8-9).

The portfolio targets are intensity targets, using a metric of “emissions/$million invested based on Enterprise Value Including Cash (EVIC).” In the Net Zero Implementation Plans, the funds commit to reporting changes against absolute emissions and weighted average carbon intensity (p.9).

The NYC pensions have not yet made any absolute emissions reduction commitments.

Companies with science-based targets

The funds have set interim targets, which they plan to advance through their engagement strategies, for real economy decarbonization plans, requiring companies representing 70% of scope 1 and 2 emissions in their public equity and corporate bonds portfolios to have science-based targets by 2025, and 90% by 2030 (NYCERS/TRS/BERS Net Zero Implementation Plans, p.10).

Climate solutions

On behalf of the pension funds it manages, the Comptroller has also set 2025 and 2035 targets to increase investments in climate solutions (defined as including renewable energy, energy efficiency, sustainable water and pollution prevention) to US$50 billion by 2035. US$37.8 billion of this amount will be invested by the three funds that have adopted climate commitments (NYCERS/TRS/BERS Net Zero Implementation Plans, p.11). As of the end of June 2023, climate solutions investments across the five NYC funds totalled US$10.5 billion (NYC Comptroller Lander and Pension Trustees Announce 24.7% Increase in Climate Solutions Investments and Commitments, NYC Comptroller press release).

The NYC Comptroller recognizes the urgency of the climate crisis and the risks it poses to individual companies and to overall portfolio performance, saying climate change poses “systemic and material risks to the global economy … and to the investment portfolios of the New York City Retirement system” (Confronting the Climate Crisis: Climate Transition, NYC Comptroller webpage).

The Comptroller clearly states that its net-zero goal is designed to “mitigate the systemic risks of climate change to our investments and the real economy” (NYCERS/BERS Net Zero Implementation Plans, p.13; TRS Net Zero Implementation Plans, p.14).

The Comptroller also recognizes that investors, including the NYC pension funds, have a role to play in mitigating these risks: “How investors finance climate transition now will substantially determine how many lives and dollars we protect in the decades to come. … New York City pension funds have recognized a fiduciary duty to mitigate the systemic and company-specific risks that climate change poses to our portfolio” (Confronting the Climate Crisis: Climate Transition, NYC Comptroller webpage).

SUMMARY

The NYC Comptroller has taken a leadership role in addressing climate change throughout its investment and stewardship processes. In addition to adopting a plan to divest from fossil fuel reserve owners, it has set expectations that portfolio companies have science-based climate targets, conducts credible and expectations-based engagement, files climate-related shareholder resolutions and publicly advocates for them, and has taken a vocal public stance on the need for investors, including fund managers, to advance climate objectives.

DETAILS

Expectations for owned companies

The NYC pensions’ Implementation Plans provide signals to owned companies about the pensions’ expectations for climate targets: by 2025, companies representing 70% of the public equities and corporate bonds portfolios’ scope 1 and 2 emissions should have science-based targets approved by credible third parties (e.g. Science-Based Targets Initiative); by 2030, that expectation expands to 90% of companies (p.10). While science-based targets provide an easily measurable metric, it is worth noting that having a set target and implementing that target are two different matters.

Escalatory framework for engagement

The NYC Comptroller has already adopted a divestment strategy for fossil fuels (see section on Fossil Fuel Exclusions below). Its Confronting the Climate Crisis: Climate Transition webpage also signals that divestment from companies in other sectors may be part of its engagement strategy: “If companies or managers demonstrate implacable opposition to taking substantive steps to reduce their GHG emissions consistent with the goal of limiting global warming to 1.5C, then the Bureau of Asset Management may recommend divestment to the trustee boards.”

Proxy voting and shareholder resolutions

New York City pension funds’ Corporate Governance Principles and Proxy Voting Guidelines outline how the Retirement Systems intend to vote, which implicitly sets out expectations for portfolio companies. In loose terms, the guidelines indicate that “The Systems support companies that proactively develop policies, initiatives, and objectives to mitigate risks related to climate change” (p.30), including supporting climate-related disclosure and oversight and supporting measures calling for the establishment of emissions reduction targets (p.30).

On board composition and competency, the guidelines note that “Boards should be composed of directors who, collectively, are best equipped to effectively oversee the company’s strategy for creating and protecting firm value,” including strategies related to overseeing climate-related and environmental risk (p.11). In 2023, when NYC funds prioritized engagement with banks, the three NYC pensions voted against directors responsible for climate risk oversight at major US banks including JPMorgan Chase, Wells Fargo, Bank of America, and Goldman Sachs (Responsible Investing, NYC Comptroller webpage).

Also in 2023, the NYC Retirement Systems brought forward resolutions calling on financial institutions JP Morgan Chase, Goldman Sachs, Morgan Stanley, and Royal Bank of Canada to set and report on absolute financed emissions targets for the energy and utilities sectors (NYC Comptroller Lander and City Pension Funds’ 2023 Shareowner Initiatives Postseason Report Highlights Leadership on Responsible Investment, NYC Comptroller press release).

Collaborative engagement

The NYC Comptroller is a member of Climate Action 100+ (CA100+), and leads engagements at Ford, General Motors and General Electric, co-leads engagements at truck-maker Paccar, and participates in substantive engagements with Duke Energy, Dominion Energy and Toyota (among others) (Confronting the Climate Crisis: Climate Transition,NYC Comptroller webpage, and New York City Retirement Systems 2022 Shareholder Initiatives, p.15). For the 2022 proxy season, the Systems provided detailed reports of climate engagements, for example urging automakers to align lobbying with the goals of the Paris Agreement, pressuring a truck-maker on its market growth plans for zero emissions vehicles, filing shareholder resolutions at utilities seeking disclosure of how the companies will align their capital expenditures with emissions reduction targets, and requesting disclosure of a Board’s climate-related competencies (New York City Retirement Systems 2022 Shareholder Initiatives, pp.14-17).

The Comptroller’s Office engages companies to align with the goals of the Paris Agreement, including by “implementing strategies and practices consistent with the decarbonization goals they have adopted. The Systems seek to improve climate-related corporate governance, curb GHG emissions, align business practices (e.g., lobbying and capital expenditures) with the goals of the Paris Climate Agreement, and strengthen climate-related financial disclosures” (New York City Retirement Systems 2022 Shareholder Initiatives, p.14).

The NYC pensions have also been leading on engagements with banks that have adopted net-zero targets but continue to provide financial services (including lending and underwriting) to fossil fuel companies engaging in new project expansion. In 2023, the NYC Comptroller filed shareholder resolutions at four North American banks calling on them to set absolute emissions reduction targets for financed emissions of energy and utility sector clients. This was a priority area for engagement in 2023 (NYC Comptroller Lander and City Pension Funds Call on Major U.S. and Canadian Banks to Set Absolute GHG Emissions Targets for High Emitting Sectors, NYC Comptroller press release).

The NYC Comptroller participated in CDP’s 2022 campaigns on corporate disclosure and science-based targets (New York City Retirement Systems 2022 Shareholder Initiatives, pp.17-18). The Comptroller is again supporting CDP’s 2023-2024 Science-Based Targets Campaign, which in 2023 sent letters on behalf of its supporters (financial institutions and multinational corporations) to “over 2,100 high-impact companies asking them to commit to and set 1.5°C-aligned Science-Based Targets."

The Comptroller has called on other investors to join together in a “high ambition” group to set standards, share data, and align action on “serious net-zero plans” along the model called for by the United Nations High Level Expert Group on Net Zero Emissions Commitments of Non-State Entities (Confronting the Climate Crisis: Climate Transition, NYC Comptroller webpage).

Direction given to external managers

The NYC Comptroller recognizes that the actions of one investor are not sufficient to manage and mitigate climate risks, writing, “[we] cannot achieve our net-zero goals unless our investment managers, in both public and private markets, actively collaborate in this effort” (NYCERS/BERS/TRS Net Zero Implementation Plans, p.28). Consequently, the funds have outlined expectations for and are undertaking engagements with the funds’ public asset managers and private markets managers. The pensions have set a goal that all managers “have a net-zero goal or science-based targets and implementation plan covering, at a minimum, assets managed for the System, by June 30, 2025.” The pensions set an expectation that asset managers’ targets should cover scope 1, 2, and material scope 3 emissions.

As part of its engagement strategy, the NYC Comptroller has publicly engaged BlackRock over concern that its investment strategy does not align with its climate commitments. The Comptroller’s letter calls on BlackRock to improve its climate strategy by publishing an implementation plan; outlining an approach to “kee[p] fossil fuel reserves in the ground and phas[e] out high-emitting assets”; and incorporating calls for the adoption of science-based targets and disclosure of climate lobbying as part of BlackRock’s corporate engagement efforts.

Policy engagement

The NYC Comptroller has a history of engaging regulators and policymakers on a range of climate and environmental issues. For example, the Comptroller has been an active supporter of the US Security and Exchange Commission’s (SEC) proposed climate-disclosure rulemaking, The Enhancement and Standardization of Climate-Related Disclosures for Investors. The Comptroller has submitted comment letters to the SEC and spoken out publicly in support of the proposed rule, including support of scope 3 emissions disclosures (New York City Retirement Systems 2022 Shareholder Initiatives, p.18).

In addition, the Comptroller has engaged policymakers on issues relevant to their corporate engagements with portfolio companies. For example, in 2022 the Comptroller’s office engaged with the Office of Management and Budget, the US Environmental Protection Agency, and the National Highway Traffic Safety Administration on vehicle emission standards (New York City Retirement Systems 2022 Shareholder Initiatives, p.18).

Accountable Paris-aligned membership

NYCERS, BERS and TRS are members of the Paris Aligned Asset Owners.

Transparency and disclosure of holdings

The NYC Comptroller provides monthly disclosures of its AUM, which is searchable in an online interactive dashboard (Pension/Investment Management: Assets Under Management, NYC Comptroller webpage). Holdings are updated within 60 days of the end of each month.

The Comptroller also reports progress toward its goals of fossil fuel divestment and investment in clean energy solutions, including a list of assets that were targeted for divestment, although this list appears not to have been updated since 2021 (NYC Climate Dashboard: Climate Finance, NYC Comptroller webpage; Fossil Fuel Divestment List).

Transparency and disclosure of climate risk

The New York City Comptroller discloses its total emissions (scopes 1, 2, and 3) by pension system on its public-facing climate dashboard (NYC Climate Dashboard: Climate Finance, NYC Comptroller webpage). As of April 2023, the NYC pension systems were on track for their interim financed emissions reduction targets (Comptroller Publishes Pension Emissions Data and Updates Dashboard on Progress Toward Climate Goals, NYC Comptroller press release).

The Comptroller’s Bureau of Asset Management is undertaking efforts “for evaluating climate risks to the portfolio more comprehensively,” including scenario analysis and identifying ways to determine alignment with 1.5°C pathways and net-zero goals (NYCERS/BERS Net Zero Implementation Plans, p.15; TRS Net Zero Implementation Plans, p. 16).

Three of NYC’s pensions have an active climate plan and each has adopted a detailed Implementation Plan that addresses each of the Comptroller’s climate transition strategies: setting and disclosing interim targets; engaging asset managers and portfolio companies; investing in climate solutions; and divesting from fossil fuel companies (Confronting the Climate Crisis: Climate Transition, NYC Comptroller webpage).

Board climate expertise and/or fossil fuel entanglement

NYCERS, TRS and BERS each have a Board of Trustees, which are largely composed of current or former public employees (webpages: Board of Education Retirement System: Board of Trustees; NYC Employees’ Retirement System: Board of Trustees; and Teachers’ Retirement System of the City of New York). Based on a review of public biographies, none are identified as having either climate expertise or fossil fuel entanglements.

The Comptroller’s office has two roles explicitly targeting oversight of climate and ESG risks: a Chief ESG Officer and a Chief Climate Officer (Leadership Team, NYC Comptroller webpage). None of the Comptroller’s Bureau of Asset Management “Leadership Team” are identified as having expertise in climate science. However, several have backgrounds working in environmental, climate and/or related political work. The City Comptroller is not identified as having climate expertise.

Executive and staff compensation and climate

Shift’s analysis did not find any disclosure indicating that the New York City Comptrollers’ office ties executive or staff compensation to the achievement of climate targets.

In 2018, NYCERS, BERS and TRS announced their intention to divest from fossil fuel companies, consistent with fiduciary duty. New York City was the first major American city to announce a full fossil fuel divestment commitment (Comptroller Stringer and Trustees Announce Successful $3 Billion Divestment from Fossil Fuels, NYC Comptroller press release).

According to the Comptroller’s NYC Climate Dashboard: Climate Finance, the funds have since divested US$3.8 billion from fossil fuel companies. The NYC Comptroller provides on its website a list of divested companies, although the list appears to date from 2021 (Fossil Fuel Divestment List).

A December 2021 press release on fossil fuel divestment progress outlined the process the Comptroller and Trustees followed to ensure divestment was consistent with fiduciary duty, including retaining Blackrock and Meketa to produce independent investment analyses which demonstrated “the risks posed by fossil fuel companies and the prudent nature of the divestment actions adopted by the Boards” (Comptroller Stringer and Trustees Announce Successful $3 Billion Divestment from Fossil Fuels).

New York City has also announced plans to exclude fossil fuels in any new private equity fund commitments. The Net Zero Implementation Plans commit the three NYC funds to “ask private managers to exclude investments in the production, exploration, or extraction of fossil fuels” (NYCERS/BERS/TRS Net Zero Implementation Plans, p.7). If the manager does not comply, the Board may not approve investment (NYCERS/BERS/TRS Net Zero Implementation Plans, pp.11-12).

“A low-carbon transition of the economy in line with science and 1.5°C pathways requires greatly increasing financing of climate change solutions, significantly reducing fossil fuel investments and ceasing investments in new fossil fuel supply projects in accordance with established net-zero scenarios, and engaging companies, managers, and policymakers to ensure net-zero alignment” (NYCERS/BERS/TRS Net Zero Implementation Plans, pp.14-16).