OPSEU Pension Trust (OPTrust)

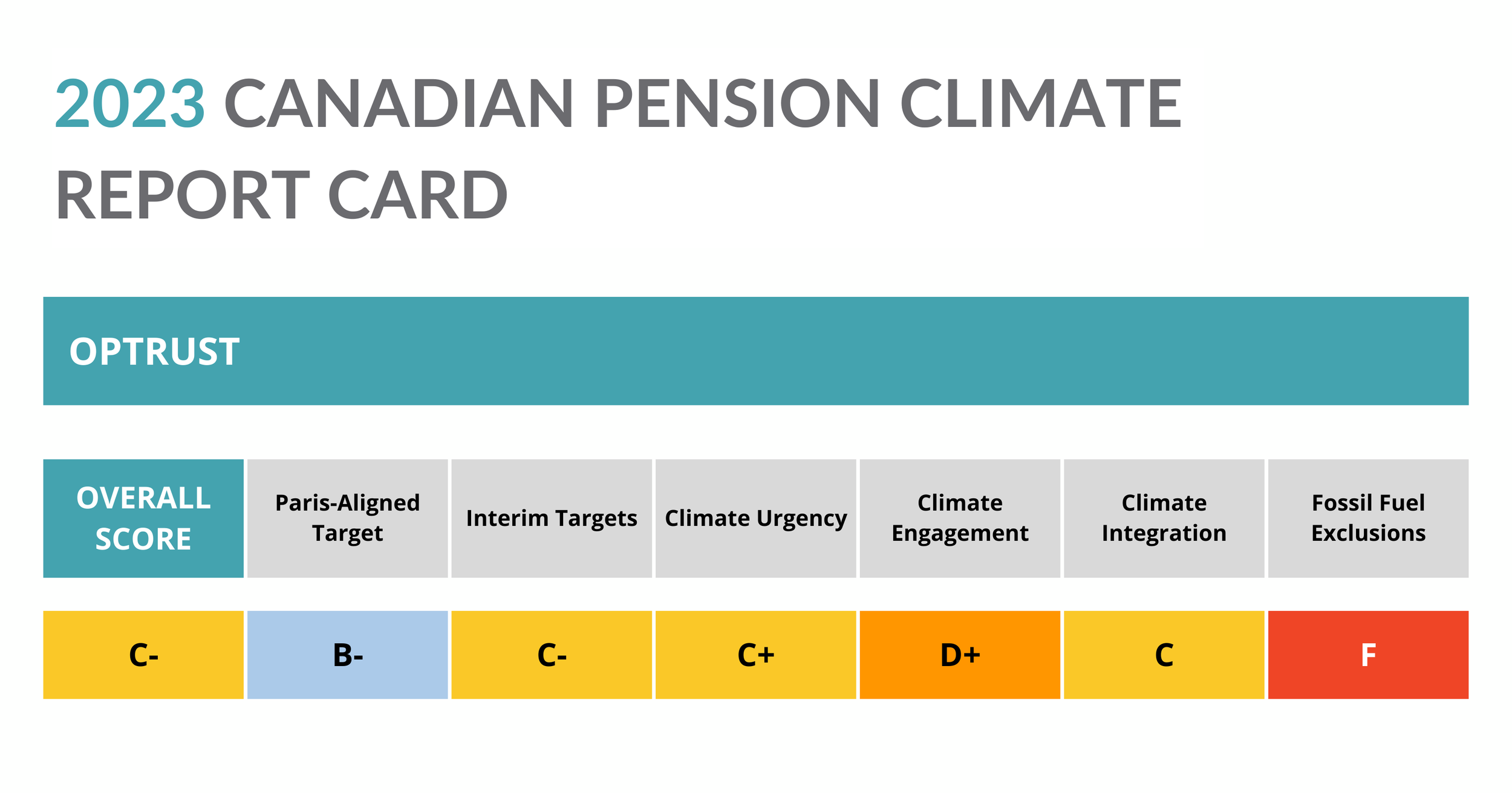

The 2023 Canadian Pension Climate Report Card assesses large Canadian pensions on their management of climate-related risks. The report is based on publicly available information to December 31, 2023.

OPTrust is the OPSEU Pension Plan for over 106,000 active and retired Ontario public servants. Most OPTrust members work for the Ontario Public Service, municipal governments and service providers and Ontario’s public college system; members also include OPSEU members who work for private companies or organizations contracted to deliver public services, such as hospitals and medical laboratories. OPTrust is also the manager for retirement savings of employees of non-profit organizations through OPTrust Select.

Assets Under Management (AUM): $24.6 billion (December 31, 2022)

OPTrust’s December 2023 Our Climate Change Strategy in Action and 2022-2023 Task Force on Climate-Related Financial Disclosures (TCFD) documents show the fund continues to integrate climate considerations into its operations, but OPTrust has set few quantitative targets and is still in the early stages of developing metrics and gathering data to determine how well the fund is managing climate-related risks.

In 2023, OPTrust:

Set an interim target to reduce emissions intensity.

Completed a portfolio footprint for scope 1 and 2 emissions, with 40% of AUM in scope.

Committed to aligning its investment strategy with the Net Zero Investment Framework.

Developed a climate metrics framework and shared a related “How-to" toolkit for other asset owners.

Reported that 25% of its external managers and funds have net-zero emissions by 2050 commitments.

Disclosed a link between climate performance objectives and compensation.

2023 UPDATES

Committed to align its strategy with the Net-Zero Investor Framework.

DETAILS

OPTrust committed in its October 2022 Aligning our portfolio with the global path to net zero: Climate Change Strategy (“Climate Change Strategy”) to achieve net-zero emissions by 2050 (p.3). In 2023, OPTrust announced a 2030 emissions intensity reduction target.

OPTrust is not a member of a credible and accountable Paris-aligned investor body, nor has it committed to follow the recommendations of the United Nations Secretary-General’s High Level Expert Group on Net-Zero Emissions Commitments of Non-State Entities. OPTrust committed in 2023 to align its strategy with the Net-Zero Investor Framework– “which is the preferred approach of the Paris Aligned Asset Owners initiative” (Our Climate Change Strategy in Action FAQ, p.2)-- but fell short of joining an investor body that will help hold it publicly accountable for its net-zero commitment.

OPTrust has not yet reported scope 3 emissions.

OPTrust states that while it has used carbon offsets in the past to offset its operational footprint, “With respect to our portfolio footprint, however, OPTrust’s focus is on the management of climate risk and opportunity, which offsets do not address” (Our Climate Change Strategy in Action FAQ, p.2).

2023 UPDATES

Committed to reduce the emissions intensity of the portfolio by 30% below 2022 levels by 2030.

DETAILS

OPTrust’s Our Climate Change Strategy in Action, released in December 2023, identified that the pension manager would track metrics in five categories: carbon exposure, climate exposure, stewardship, solutions and process (pp.16-17). Some associated climate-related targets were announced, which are discussed below.

Emissions reductions

OPTrust committed to reduce the portfolio’s emissions intensity (scope 1 and 2) by 30% below 2022 levels by 2030 (p.19). This commitment is less ambitious than that of both its smaller and larger peers, such as the University Pension Plan and the Investment Management Corporation of Ontario.

The role of interim targets is to drive investment-making decisions today toward alignment to net-zero. A weak commitment for 2030 is unlikely to be a significant driver of OPTrust’s investment and stewardship decisions in the near-term and is insufficient to accelerate climate action in line with the Paris Agreement, which requires global emissions to be cut in half by 2030.

Other targets

Other commitments outlined in OPTrust’s Our Climate Change Strategy in Action included completing climate evaluations on investment partners, engaging with partners and assets to improve emissions data, and implementing climate due diligence on new direct investments and external partner commitments, all by 2025 (p.19). These commitments are described further in the Climate Integration section of this analysis.

2023 UPDATES

None

DETAILS

OPTrust acknowledges the existential risks of the climate crisis, the risks and opportunities that the crisis poses to the plan, and that the pension manager has a role in addressing it. OPTrust communicates that the plan must position itself to adapt to different climate trajectories, but does not acknowledge that OPTrust’s investment decisions have the potential to affect climate trajectories.

Sample language from OPTrust’s 2022 Funded Status Report (p.39):

“As stewards of our members’ capital, our role is to look far ahead at challenges and opportunities that could affect members’ retirement security across multiple generations. Chief among these is climate change. A defining issue of our time, it presents a real, measurable risk to our members that cannot be ignored in our investment approach.”

Sample language from OPTrust’s Our Climate Change Strategy in Action (p.5):

“As the global economy transitions to net zero, integrating climate considerations into our investment and risk-management approach across all asset classes will be integral to delivering the returns necessary to preserve plan sustainability.”

2023 UPDATES

Created a framework for ESG data and shared framework creation process with peers.

Reported supporting climate-related engagements with 287 companies in 2022.

SUMMARY

OPTrust has not set the expectation that companies in its portfolio have credible net-zero transition plans. It does not yet have time-bound targets for successful climate engagements, or an escalation process should engagement be unsuccessful. In OPTrust’s 2022 Climate Change Strategy, the fund stated that 2022-2023 priorities included implementing stewardship plans for high-risk assets (p.9), but no details or progress were reported on this priority in 2023’s Our Climate Change Strategy in Action.

DETAILS

Expectations for owned companies

For direct investments, OPTrust “advocates for the importance of managing climate-related risks” (2021 Responsible Investing Report, p.15). Specific expectations, requirements or a process for escalation are not provided.

Direction given to external managers

OPTrust said in its 2021 Responsible Investing Report that the fund’s Responsible Investing Partner Evaluation was being used to assess third-party managers on information, including the manager’s approach to climate change (pp.6, 10). While OPTrust’s Our Climate Change Strategy in Action update did not provide an update on this evaluation, it did report that OPTrust used its new COMPAS (Capturing OPTrust’s Management and Progress Around Sustainability) framework to identify that a quarter of its external managers and funds have net-zero by 2050 commitments (p.18).

The fund stated that it ”committed to implement enhanced climate due diligence on 100% of new direct investments and external investment partner commitments by 2025” (Our Climate Change Strategy in Action, p.19). OPTrust could improve transparency by outlining what enhanced climate due diligence entails and its goals for ensuring that this due diligence results in climate-aligned investments.

Proxy voting

OPTrust has some climate-related details in its Proxy Voting Guidelines (effective December 8, 2023). In general the fund supports TCFD disclosure, will encourage “climate-competent boards” and “may support” asking companies to set Paris-aligned targets (pp.22-23). Where climate change presents a “material impact”, OPTrust expects TCFD disclosure to be incorporated in the company’s annual filings, and will vote against annual reports and/or the Audit Committee Chair if there is no disclosure or if disclosure does not demonstrate an “appropriate climate risk evaluation” (p.8-9).

OPTrust’s proxy votes are not posted publicly, making it challenging for members and stakeholders to assess its voting record. However, OPTrust has a relatively small allocation to public equities (11.8% of the portfolio as of December 31, 2022, as per OPTrust’s 2022 Funded Status Report, p.31)

In its 2022 Responsible Investing Report, OPTrust reported voting in support of 28 proposals to improve climate risk management at portfolio companies. The pension manager did not report any climate-related votes against directors (p.6).

Collaborative engagement

OPTrust is an “investor supporter” of Climate Action 100+. According to Climate Action 100+, an investor supporter is a signatory to the engagement initiative and supports the initiatives’ goals, but does not participate directly in engagements with focus companies.

OPTrust listed one example of a climate-related engagement in its 2022 Funded Status Report. Following OPTrust’s engagement with Waste Connections in 2022, the company committed to reduce its absolute scope 1 and 2 emissions by 15%, with no baseline or timeline provided (p.41). While OPTrust reported this as a successful climate-related engagement, the target does not seem to have been particularly ambitious– Waste Connections reported nearly achieving this target the same year that it was set, reducing its scope 1 and 2 emissions by 14% in 2022. The Investment Management Corporation of Ontario (IMCO) reported in its 2022 ESG Report that in collaboration with Climate Engagement Canada it engaged Waste Connections to “set more rigorous interim emission reduction targets” and subsequently welcomed the company’s commitment to set a science-based target.

OPTrust also reported in March 2023 on its engagement with mining conglomerate BHP, which purportedly led to BHP launching “a 2030 objective to create nature positive outcomes by having at least 30 percent of its land footprint under nature positive management” (2022 Funded Status Report, p.41).

OPTrust reported supporting climate-related engagements, through its external engagement partner, with 287 companies in 2022, and an additional 181 as of Q2 2023 (Our Climate Change Strategy in Action FAQ, p.1). Minimal details are provided regarding what “supporting” an engagement entails.

OPTrust’s engagement credibility would be strengthened by aligning its intended engagement outcomes with the goals of the Paris Agreement and disclosing time-bound expectations and an escalation process for engagements.

Policy engagement

Given that OPTrust recognizes that “addressing plan sustainability requires addressing climate sustainability” (Our Climate Change Strategy in Action, p.5), the fund should also work to ensure, through vocal and assertive advocacy, that governments in Canada and around the world are developing and implementing stringent and durable laws, policies and regulations that provide certainty for businesses and accelerate emissions reductions in line with the Paris Agreement.

Other: engagement with peers

OPTrust has made efforts to share with peer asset owners the fund’s process for integrating climate considerations, for example with its Designing a Climate Metrics Framework for Investment Portfolios - A Toolkit for Asset Owners in 2023, and its Preparing our Portfolio for the Future: Integrating Climate Scenarios into Asset-Liability Management case study in 2022.

2023 UPDATES

Completed first portfolio footprint, with 40% of AUM in-scope.

Disclosed a vague link between staff compensation and climate objectives.

Made commitments to conduct climate assessments for core investment partners, increase total reported emissions data, and implement enhanced climate due diligence on new direct investments and external investment partner commitments.

Accountable Paris-aligned membership

OPTrust is not a member of any accountable and credible Paris-aligned investor body.

Transparency and disclosure of holdings

OPTrust does not disclose its holdings or their valuation.

Transparency and disclosure of climate risk

OPTrust’s 2022-2023 TCFD Report provided a detailed discussion of climate-related risks and opportunities. However, it is difficult to assess the degree to which these risks threaten the fund without disclosure of the fund’s assets. OPTrust has not yet disclosed the percent of the portfolio allocated to high-carbon assets or its total investments in sustainable solutions. While OPTrust highlights its growing investments in renewable energy and other climate solutions, its Our Climate Change Strategy in Action update does not mention that in 2023 OPTrust increased its joint stake in fossil gas infrastructure company Superior Pipeline (now known as Superior Midstream) from 50% to 100%.

Disclosure of carbon footprint

OPTrust reported its portfolio carbon footprint for the first time in its 2022-2023 TCFD Report, including public markets assets and direct investments in private equity, infrastructure and real estate. The value of in-scope assets was $9.9 billion, or around 40% of OPTrust’s $25 billion in AUM (p.14). OPTrust states it plans to incorporate scope 3 emissions as data availability and quality improve (p.13); anticipates increased direct reporting of emissions (p.16); plans to report emissions associated with sovereign bonds by 2024 (p.16); and intends to obtain independent third-party assurance over its carbon footprint “in the future” (p.16).

Scenario analysis

In 2021 OPTrust undertook climate scenario analysis, including orderly and disorderly transition pathways that assume 1.5°C and 4°C of global warming, respectively. Details of the analysis were shared with stakeholders in OPTrust’s 2022 paper, Preparing our Portfolio for the Future: Integrating Climate Scenarios into Asset-Liability Management (pp.7-9).

Contemporaneity of climate plan

OPTrust’s 2018 climate plan was updated in 2022 with a commitment to achieve net-zero emissions by 2050. In 2023, OPTrust’s Our Climate Change Strategy in Action added an interim emissions reduction target and further details, such as a climate-compensation link, an initial carbon footprint, and a framework for climate metrics. The document also included commitments to:

conduct climate assessments on core, strategic investment partners by 2025;

engage with 100% of core, strategic investment partners and higher-risk, directly-owned assets to promote the collection and reporting of emissions data by 2025; and

implement “enhanced climate due diligence” on 100% of new direct investments and external investment partner commitments by 2025 (p.19).

Board climate expertise and/or fossil fuel entanglement

OPTrust does not identify any board members as having climate expertise, although board members’ bios on OPTrust’s website show that the Board Chair has a degree in Environmental Engineering and works at Ontario’s Ministry of the Environment; two board members have completed the Institute of Corporate Directors’ Board Oversight of Climate Change Program; and another Board member “regularly attends education and training sessions on emerging issues such as climate change oversight, AI, risk management, and cybersecurity.”

OPTrust stated in its 2022-2023 Task Force on Climate Related Financial Disclosures that the Board Investment Committee “monitors the implementation of OPTrust’s enhanced climate change strategy which was approved by the Board in October 2022, and receives regular reporting on: (1) new initiatives or analyses underway; (2) insights from research that have implications for how we invest; (3) progress against the strategy and metrics and (4) regulatory or policy changes and annual Fund disclosures” (p.5).

No OPTrust Board members appear to have current fossil fuel entanglements.

Executive and staff compensation and climate

OPTrust’s Our Climate Change Strategy in Action report states that, “since 2022, we’ve formally integrated climate change considerations into OPTrust’s corporate strategy and the annual qualitative performance objectives of every department. Achievement of performance objectives is ultimately tied to compensation. This formal integration ensures that we consider climate in all material parts of what we do and how we invest” (p.21). OPTrust does not give specifics on how compensation is linked to climate.

2023 UPDATES

None

OPTrust has no exclusions on investments in coal, oil, gas or related infrastructure.

OPTrust’s Statement of Responsible Investing Principles states that, “we may choose to exclude, based on [responsible investing] considerations, entities from the investment portfolio where … the likelihood of effectively mitigating associated ESG risks through active ownership avenues, such as engagement, is low” (p.4).